What does a Insurance Specialist do?

An Insurance Specialist focuses on providing expert advice on insurance policies and coverage. This role involves understanding various types of insurance, such as health, auto, life, and property insurance. Specialists help clients choose the right policies to meet their needs and explain coverage details clearly. They assess risks and recommend appropriate coverage options to clients.

Insurance Specialists interact with clients to evaluate their insurance needs and provide personalized recommendations. They review policy documents, explain terms and conditions, and assist with claims when necessary. They work closely with clients to ensure they understand their coverage and any changes to their policies. Specialists also keep up-to-date with industry changes and regulations to provide accurate information. This role requires strong communication skills and a detailed understanding of insurance products.

How to become a Insurance Specialist?

Becoming an Insurance Specialist is a rewarding career choice. It offers stable employment and the opportunity to help people in need. This profession involves helping clients choose the right insurance policies to meet their needs. Achieving this role requires a clear path and dedication. Follow these steps to start your career as an Insurance Specialist.

First, gain a high school diploma or equivalent. This is the basic requirement to enter the job market. Many employers prefer candidates with a bachelor's degree in business, finance, or a related field. Higher education can open more job opportunities and improve your chances of being hired.

- Obtain a high school diploma or GED.

- Consider a bachelor's degree in business, finance, or a related field.

- Gain relevant work experience.

- Obtain the necessary licenses and certifications.

- Continuously improve your skills and knowledge.

Next, gain relevant work experience. This could be through internships, entry-level jobs, or volunteer work in the insurance industry. Experience helps you understand the industry and develop key skills. It also makes your resume stand out to potential employers.

Obtain the necessary licenses and certifications. Each state has different licensing requirements. Research the specific requirements in your area. Some common licenses include Property and Casualty or Life and Health insurance licenses. Certifications, such as Certified Insurance Counselor (CIC) or Associate in Risk Management (ARM), can also improve your qualifications.

Continuously improve your skills and knowledge. The insurance industry is always changing. Stay updated with the latest trends and regulations. Attend workshops, seminars, and training sessions. Networking with other professionals can also provide new opportunities and insights.

How long does it take to become a Insurance Specialist?

Starting a career as an Insurance Specialist often begins with a strong interest in finance and helping others. This role involves understanding various insurance policies and assisting clients in finding the right coverage. Many professionals enter this field with a high school diploma, which usually takes about four years.

After high school, some may choose to attend a community college or a vocational school for a specialized program. These programs can last from one to two years. Others opt for a bachelor’s degree in business or a related field, which takes about four years. With the right education and experience, someone can prepare to become an Insurance Specialist in a few years. Continuous learning and staying updated on insurance trends help specialists stay competitive in the job market.

Insurance Specialist Job Description Sample

An Insurance Specialist is responsible for providing expert advice and managing insurance needs for clients. This role involves assessing risks, recommending appropriate insurance policies, and handling claims and customer inquiries.

Responsibilities:

- Assess clients' insurance needs by evaluating their financial situation and risk profile.

- Provide expert advice on various insurance products, including life, health, auto, and property insurance.

- Prepare and present insurance policy proposals to clients, ensuring they understand the coverage and benefits.

- Process and manage new insurance applications, renewals, and policy changes.

- Coordinate with insurance underwriters to ensure timely and accurate policy issuance.

Qualifications

- Bachelor’s degree in Business, Finance, Insurance, or a related field.

- Relevant certification (e.g., Chartered Insurance Counselor (CIC), Chartered Property Casualty Underwriter (CPCU)) is a plus.

- Proven experience in a similar role, preferably in an insurance company.

- Strong knowledge of insurance products, policies, and industry regulations.

- Excellent communication and interpersonal skills to interact with clients and colleagues.

Is becoming a Insurance Specialist a good career path?

An Insurance Specialist holds a crucial role in the insurance industry. They help clients choose the right insurance policies and manage their claims. This role involves a mix of customer service and sales skills. Specialists often work in offices, but some jobs allow remote work. The job can be rewarding for those who enjoy helping others and solving problems.

Working as an Insurance Specialist comes with its own set of pros and cons. On the positive side, job opportunities are plentiful in various sectors, including health, auto, and life insurance. Specialists often enjoy a flexible schedule, which can lead to a better work-life balance. Many companies offer training and career advancement opportunities. However, there are some challenges to consider. The job can be stressful, especially when dealing with claims or unhappy clients. Specialists also need to stay updated with changing laws and regulations, which requires continuous learning.

When looking at the pros and cons, it’s important to weigh both sides. An Insurance Specialist career offers stability and growth potential. However, the job can also be demanding and requires a strong ability to handle pressure.

Here are some pros and cons to consider:

- Pros:

- Many job opportunities

- Flexible work schedules

- Career advancement options

- Helping others and solving problems

- Cons:

- Potentially stressful situations

- Continuous need for learning

- Handling unhappy clients

What is the job outlook for a Insurance Specialist?

Job seekers looking to become an Insurance Specialist can find a stable career path ahead. According to the U.S. Bureau of Labor Statistics (BLS), there are about 22,100 job openings each year. This occupation is expected to see a slight decrease of 3.2% in job openings from 2022 to 2032. Despite this, the role remains significant, offering a dependable opportunity for those seeking stability in their career.

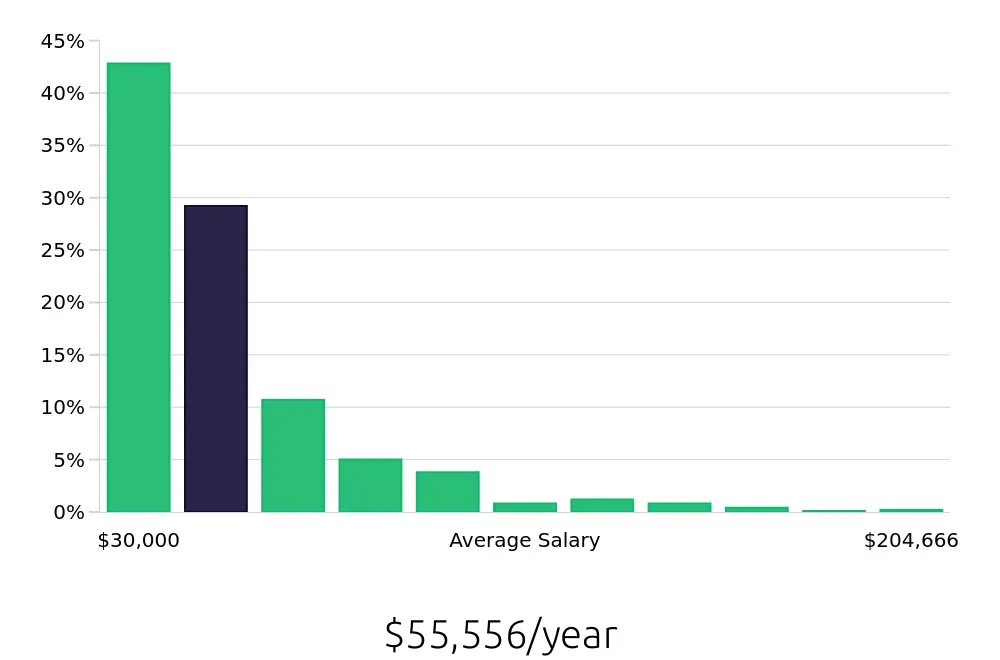

For those interested in the financial aspects, the BLS reports an average annual salary of $49,530 for Insurance Specialists. This translates to an hourly wage of $23.81. These figures reflect the value of the expertise and skills required for this position. The compensation is competitive, making it a rewarding career choice for many professionals.

The role of an Insurance Specialist is crucial in helping individuals and businesses manage their insurance needs. As the industry continues to evolve, professionals in this field will have ample opportunities to grow and advance. With a positive job outlook and a stable income, this career path is well worth considering for those in the job market.

Currently 296 Insurance Specialist job openings, nationwide.

Continue to Salaries for Insurance Specialist